Foreland Refining

Invest Now

Raised

$579,000

Days Left

Closed

Business Description

Earn Steady Income from a Strategic Refinery Asset

Stake your claim in America’s energy future. Invest in Foreland Refining Corp., owner and operator of Eagle Springs, Nevada’s only producing oil refinery. Located near the historic Railroad Valley, the basin where Nevada’s oil story began, Foreland delivers the fuels that keep the West running. It’s a proven, revenue-generating operation with long-standing customers.

Now, for the first time, investors can participate directly in that production by investing in a cash-return opportunity tied to real barrels, not hypothetical projections.

Problem

A Regional Crisis Creates a Local Advantage

Historically, Nevada has relied on California for as much as 88% of its transportation fuel supply. But with that supply chain under pressure, the region now faces rising fuel costs and increasing supply risks.

What’s Driving the Opportunity?

- • California refineries are shutting down, cutting capacity by 21%

- • 63% of California’s crude is imported and vulnerable to global shocks

- • EVs are growing, but can’t fill the gap yet

- • Gas-powered vehicles are still dominant, especially in construction, mining, and commercial use

Regional demand remains strong, and Foreland is ready to step in and supply it. As one of the only active refining operations in the region, Foreland turns this challenge into a strategic advantage.

That means real output, real revenue, and income-linked returns for investors.

Solution

Meet Foreland: Built to Scale. Ready Now.

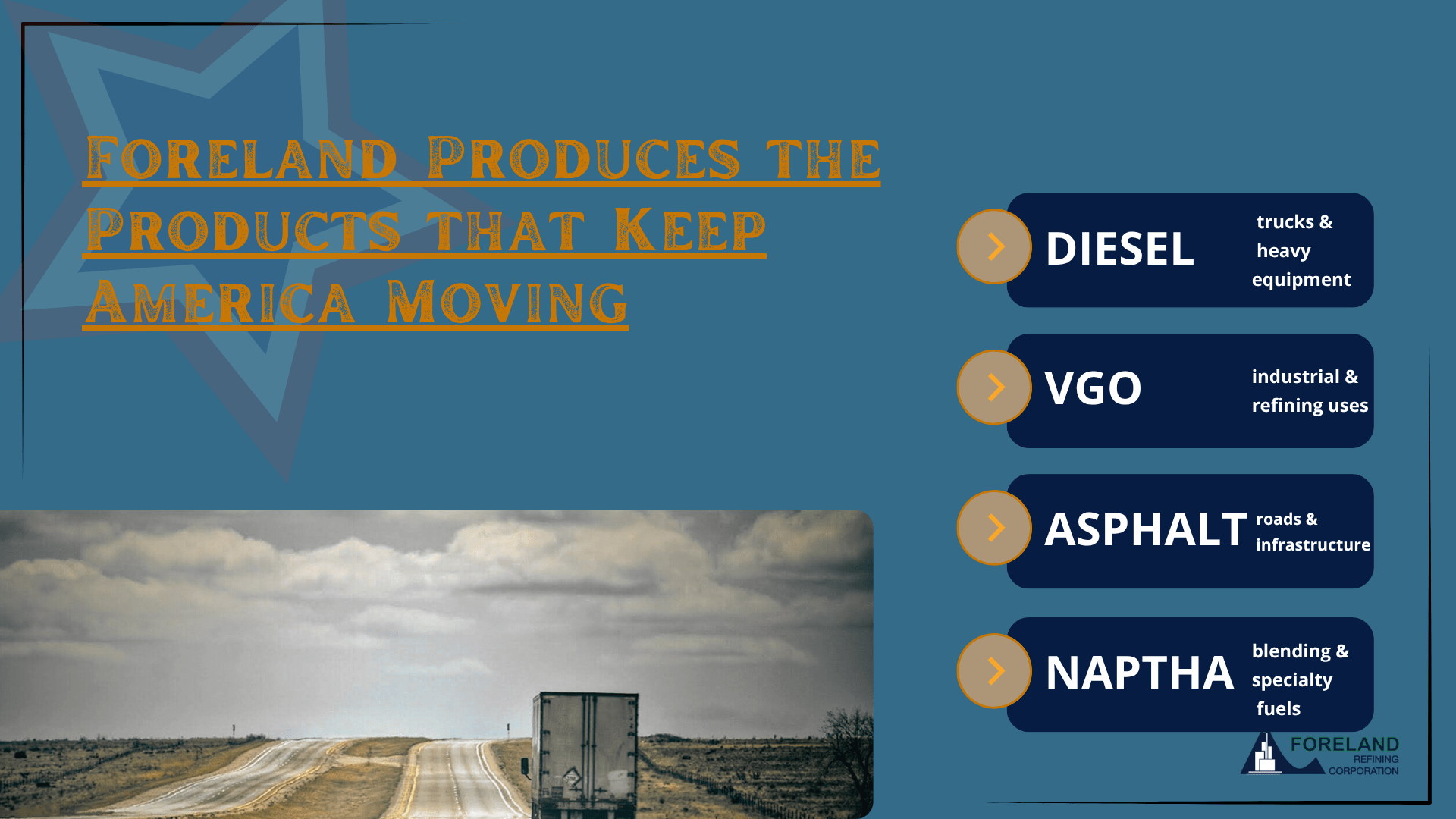

Foreland produces the products that help keep the Western U.S. moving by delivering essential energy products directly to major regional buyers. This reduces costly transport, limits dependence on California’s unstable supply, and supports scalable, high-margin growth.

Foreland isn’t just a refinery. It’s energy infrastructure that pays, and a blueprint for local energy independence in action.

- • Diesel for trucks and heavy equipment

- • Asphalt for roads and infrastructure

- • VGO for industrial and refining (used in gasoline and aviation fuel)

- • Naphtha for blending and specialty fuels

Business Model

Powering Profit and Planet: Foreland’s Winning Strategy

At its core, Foreland operates on a straightforward model: we refine fuel, we sell it regionally, and we generate revenue from every barrel. That’s what makes our investment structure so reliable.

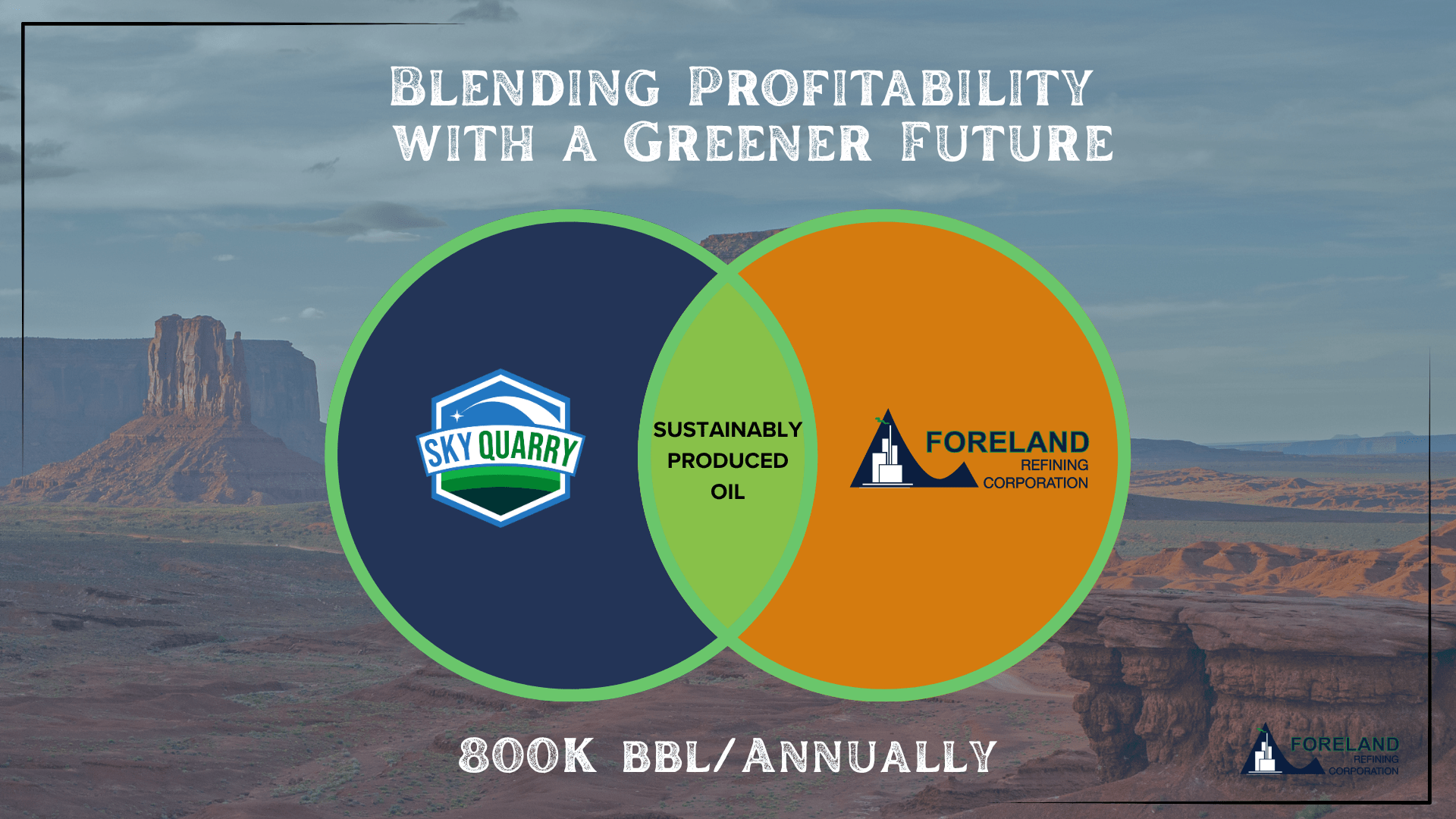

But Foreland is more than just a refinery. It’s part of a larger story. As a subsidiary of Sky Quarry, we are part of a vertically integrated, forward-looking energy platform that combines traditional fuel production with sustainable innovation.

We’re already producing high-demand petroleum products, and we’re preparing to expand by refining recycled heavy oil sourced from asphalt shingles in Utah. It’s a smart, scalable way to meet demand, reduce waste, and create new value from old materials.

Market Projection

Fueling the New Gold Rush in Railroad Valley

Nevada’s lithium boom is more than a headline. With billions flowing into resource development, it is triggering a modern industrial surge. Just like in the original Gold Rush, the strongest opportunities are often found in supplying the rush, not chasing it.

Foreland Refining Corp. operates in Ely, Nevada, a region with a long history of oil, minerals, and energy production. Today, that legacy continues with a new wave of energy materials like lithium. Our refinery is already supplying the diesel, asphalt, and specialty fuels that power the trucks, drills, and infrastructure supporting this growth.

Competition

Outpacing the Giants: Foreland’s Edge in a Crowded Field

The Western U.S. fuel market is dominated by aging California giants. These legacy refiners face shutdowns, rising costs, and mounting regulatory pressure, leaving the region increasingly vulnerable to supply disruptions.

As they struggle to keep up with demand, Foreland is stepping in with a smarter, locally anchored solution. Our location in the heart of Nevada’s energy corridor puts us in a prime position to supply the fuels that power the lithium boom, major infrastructure projects, and the heavy transport sector.

We are not chasing trends. We are serving the real economy with real product.

Traction & Customers

Real Operations. Real Revenue. Now Open to Investors.

This isn’t a startup story. It’s a revenue-generating refinery with over 20 years of operations, now offering income-based returns to everyday investors.

✔ Operating for 20+ years near Ely, Nevada

✔ Produces diesel, asphalt, vacuum gas oil, and naphtha

✔ Current permitted capacity: 800,000 barrels/year*

✔ Serving key Western markets: Southern California, Nevada, Utah, Idaho

✔ Supplying major regional buyers

*Foreland expects to reach peak level during periods of high seasonal demand with production rising in the summer and easing back in winter. At full capacity, this translates to an annualized peak rate of 800,000 barrels, though actual output will vary seasonally.

Investors

Bottom Line: The Investment That Pays and Powers

This is more than just an income opportunity. It’s a chance to be part of something that matters. By participating in this offering, you’re helping strengthen regional fuel security, support sustainable innovation, and power the industries driving the Western U.S. economy.

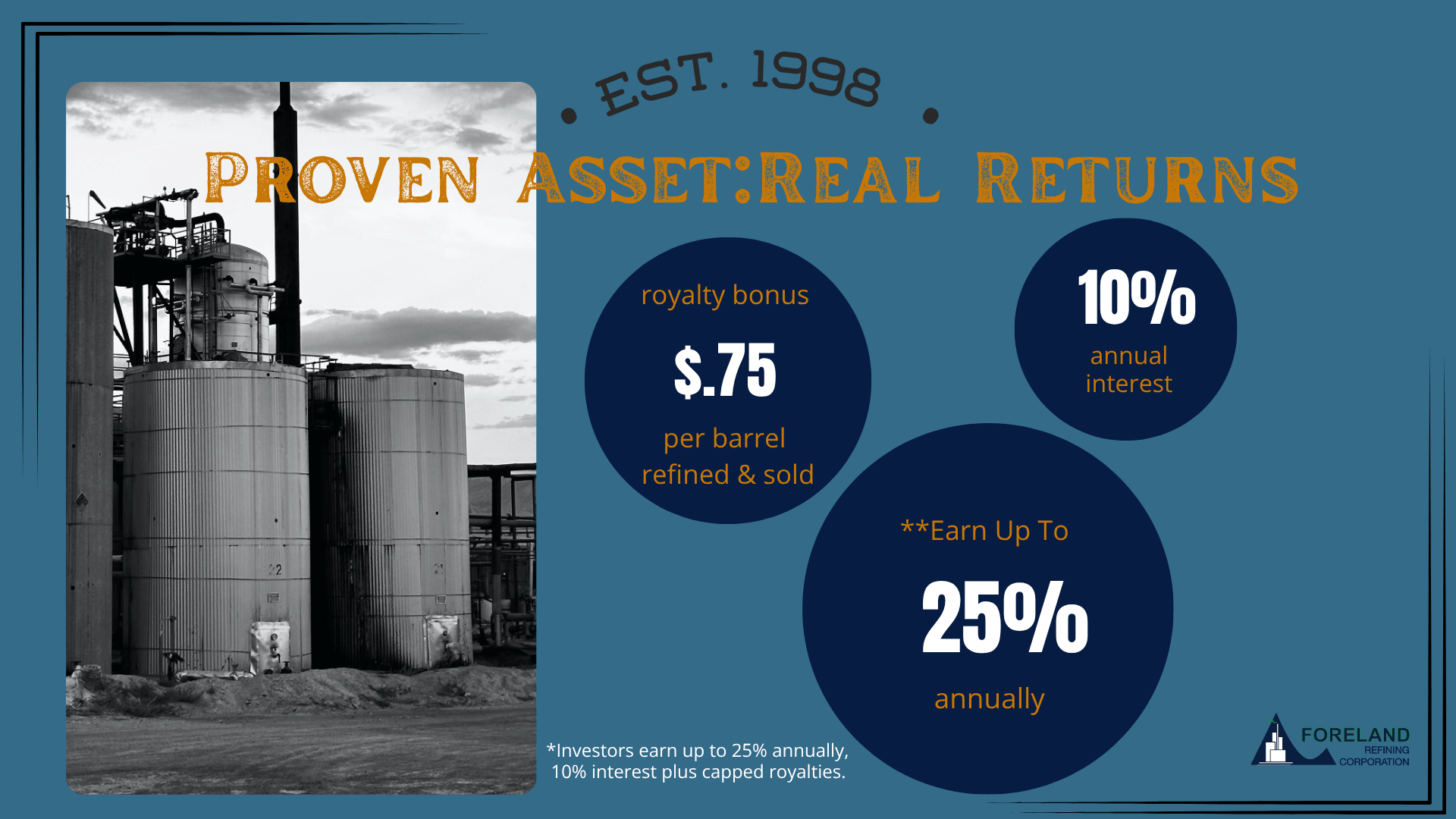

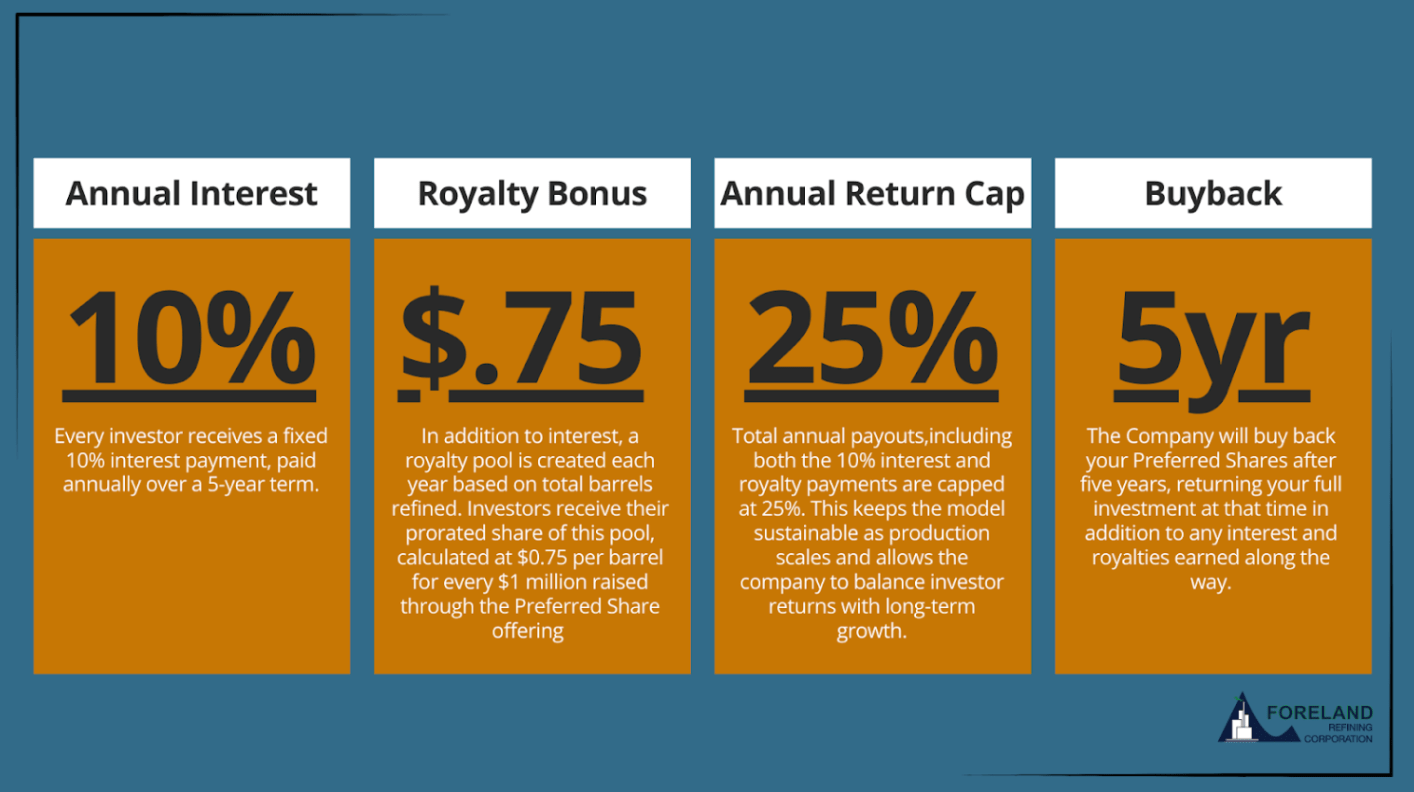

And while you’re making a difference, you’re also earning. With a fixed 10% annual interest, a royalty tied to actual barrels refined and sold, and a built-in five-year exit, Foreland offers investors a clear, cash-return model.

Like the suppliers of the original Gold Rush and today’s armchair oilman, you’re not chasing hype. You’re backing the infrastructure that fuels it — earning from a refinery already in production. No drilling wild wells. Just income from barrels refined and sold into real markets.

Sources:

California Energy Policies are Affecting Gasoline Prices in Other States

63% of California’s crude comes from overseas

California is falling behind on its EV Goals

Terms

Up to $1,235,000 in Series A 10% Redeemable Preferred Stock at $100.00 per share with a minimum target amount of $10,000.

Offering Minimum: $10,000 | 100 shares of Series A 10% Redeemable Preferred Stock

Offering Maximum: $1,235,000 | 12,350 shares of Series A 10% Redeemable Preferred Stock

Type of Security Offered: Series A 10% Redeemable Preferred Stock

Purchase Price of Security Offered: $100.00 per Share

Minimum Investment Amount (per investor): $1,000.00

Preferred Dividend: The Preferred Shares will carry an annual dividend payment of ten percent (10%). The dividend on the Preferred Shares shall accrue, beginning from the date of issuance. Dividends shall be computed on the basis of the actual number of days elapsed and a 365-day year. The dividends shall accrue and be paid to the holder of the Preferred Shares within fifteen (15) days of the end of each calendar year. The Preferred Shares will be senior preferred equity of the Company and contain customary provisions restricting the payment of dividends on, and the repurchase of, junior and pari passu equity at any time when all dividends on the Preferred Shares have not been paid in full in cash.

Conversion: The Preferred Shares are not convertible into shares of the Company’s common stock.

Voting Rights of the Preferred Shares: The Preferred Shares do not have any voting rights. However, the Preferred Shares shall have consent rights with respect to (i) taking actions adversely affecting the rights, preferences and privileges of the Preferred Shares (including by merger, consolidation or otherwise); and (ii) issuing securities that are senior or pari passu to the Preferred Shares.

Royalty: Holders of the Preferred Shares shall receive a royalty of $0.75 (for every $1 million of Preferred Shares, or part thereof) per barrel of crude oil refined and sold by the Company at all times while the Preferred Shares are outstanding (“Royalty Payment”). The Royalty Payment shall be paid to the holders of the Preferred Shares within thirty (30) days of the Company annual financial statements being audited and filed with the SEC as part of its parent company’s, Sky Quarry Inc. (“Sky Quarry” or “Parent Company”), obligations to file a Form 10-K with the SEC (“Royalty Payment Date”). The amount of the annual Royalty Payment shall not exceed an aggregate return of more than twenty-five percent (25%) per annum to the holders of the Preferred Shares, inclusive of the annual 10% Preferred Dividend.

Redemption: The Preferred Shares shall be redeemed by the Company on the date that is five (5) years after the date of issuance (“Automatic Redemption Date”) at a price equal to the Liquidation Preference. If the Preferred Shares are redeemed prior to the Automatic Redemption Date between the date of issuance and the date that is: (i) thirty-six (36) months thereafter, the Preferred Shares may be redeemed by the Company in whole or in part in its sole discretion at a price equal to 110% of the Liquidation Preference; (ii) between thirty-six (36) months and forty-eight (48) months after the issuance of the Preferred Shares, the Preferred Shares may be redeemed by the Company in whole or in part in its sole discretion at a price equal to 105% of the Liquidation Preference; or (iii) between forty-eight (48) months after the issuance of the Preferred Shares and the Automatic Redemption Date, the Preferred Shares may be redeemed by the Company in whole or in part in its sole discretion at a price equal to 103% of the Liquidation Preference. If the Preferred Shares are redeemed prior to the Automatic Redemption Date, the holder of the Preferred Shares shall be entitled to their Royalty Payment through the date of redemption.

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $1,000.00. The Company must reach its Target Offering Amount of $10,000 by November 3o, 2025 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority.

The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$100.00

Shares For Sale

12,350

Post Money Valuation:

N/A

Investment Bonuses!

N/A

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

November 30, 2025

Minimum Investment Amount:

$1000

Target Offering Range:

$10,000-$1,235,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Marcus Laun

EVP and Director

BackgroundMarcus Laun has spent the past twenty years as a founding principal or senior advisor to over fifteen publicly and privately held companies. His experience includes advising and investing Nurture, Inc. an organic baby food company which eventually sold to Group Danone for $250mm. Marcus is also founder and CEO of GrowthCircle.com and Geopulse Exploration Inc., a media company specializing in the production and distribution of short films for corporate clients. He also has advised and raised capital for companies in the solar, wind, oil, gas, and alternative fuel industries. As Managing Director of Knight Capital Group (the largest market-maker of equities in the US)., he oversaw syndicates for over $300 million in financing. He has a BS in Hotel Management from Cornell University, and an MBA from Columbia University.

Company Name

Foreland Refining

Location

US Hwy 6

Suite 101

Currant, Nevada 89301

Number of Employees

20

Incorporation Type

C-Corp

State of Incorporation

Texas

Date Founded

May 29, 1998

Raises half the minimum amount

Foreland Refining has raised half of the target offering amount on June 27, 2025. $8,500 has been raised at this time.

Raises 100% of the minimum amount

Foreland Refining has raised the target offering amount on June 27, 2025. $15,500 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.